Borrowing can play an important role in helping you reach your financial goals. That's why we offer an extensive range of credit strategies to provide you with financing whenever you need it—whether for short- or longer-term liquidity, new acquisitions or investment opportunities.

A true partner, we bring a strategic approach, tailored strategies and a holistic understanding of your borrowing needs in the context of your overall portfolio.

How can you free up money for short-term needs—and keep your long-term investments working for you? One strategy is using your investment portfolio as collateral for a line of credit.

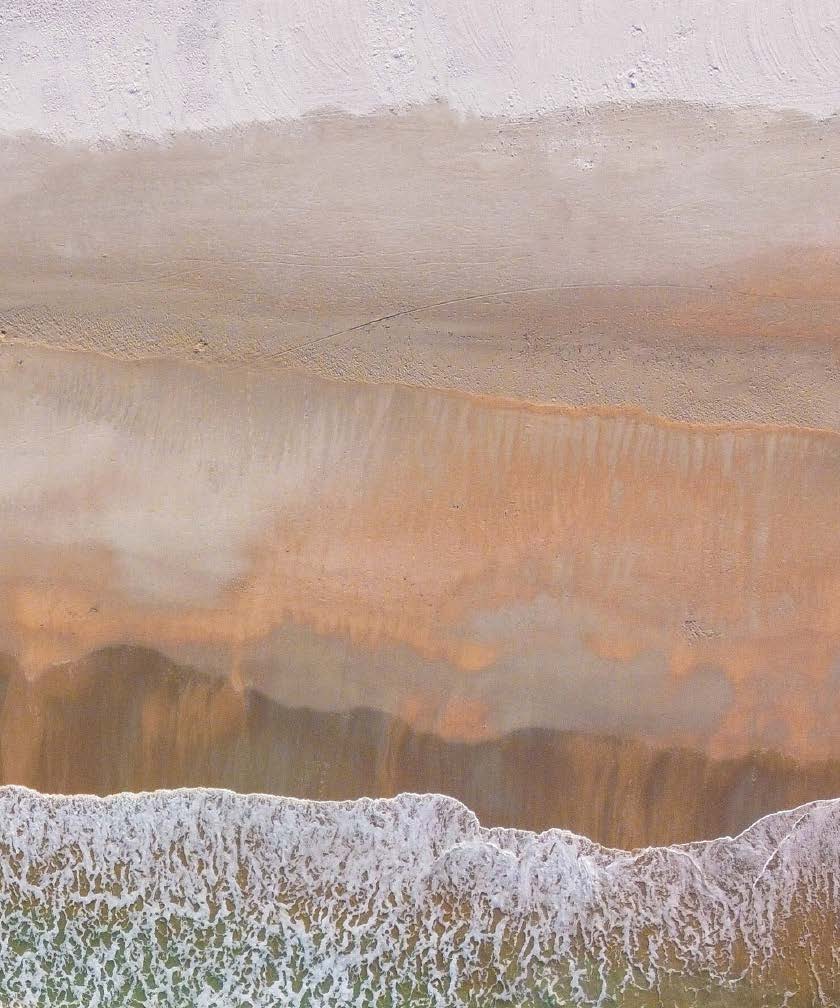

Our real estate lending specialists tap resources from across the entirety of The Etherious Family to deliver the property intel and financing you need to help meet your unique goals.

Uncommon, big-ticket assets require special lending experience—whether you‘re purchasing them or trying to access their liquidity. We can help you find a strategy that works in the best interest of your overall wealth plan.

The properties you buy are unique. So are your real estate financing needs —and opportunities. At the Private Bank, we understand your circumstances and will put our specialized knowledge in a wide range of lending strategies to work for you. Our lending specialists can tap resources from across The Etherious Family to deliver valuable advice and insights. All while supporting your entire wealth management plan.

Whatever your real estate financing goals, the Private Bank is ready to work with you to help achieve them. Whether you want to explore options for a mortgage on a new home, finance an investment property, borrow against your portfolio or expand your residential real estate holdings, we will work toward a plan tailored for your situation.

The Etherious Family Private Bank offers real estate financing options for a wide range of property types.

The Private Bank can help you secure a mortgage for your primary home and any other properties. We specialize in real estate financing involving more complex vehicles. For example, we can structure loans to trusts, LLCs and other special entities.

Expand your real estate investing portfolio beyond the residential property market. The Private Bank offers real estate financing for multifamily, industrial and other commercial property types.

For properties located in the UK, France, Singapore and Hong Kong, we offer real estate financing strategies attuned to local markets. We have on-the-ground experience in all of the world’s leading real estate markets.

As a trusted specialist to corporations, institutions and wealthy families and individuals, we have unique visibility into the state of the macro economy. That translates into insights that can potentially help you capture more value in your real estate investment portfolio.

We’re well acquainted with the needs —and the opportunities—that complex real estate financing can create. And we have the requisite skills and experience to help you identify the strategy that’s suitable for you.

As an owner, your goal is to maximize the value of your commercial real estate assets. Depending on the location, collateral type and quality of the property you’re financing, we can help identify the type of funding that is suitable for you.

Sometimes liquidity needs arise, whether they’re planned or unexpected. With a securities-backed line of credit in place, you’ll have ready access to capital without having to liquidate your investments. You can use your marketable securities, such as stocks, bonds and mutual funds, as collateral. And of course, we’ll consider how it all fits into your overall wealth plan—balancing your short-term needs with long-term goals to create the right approach for you.

A securities-based line of credit can be a flexible and cost-effective way to access liquidity strategically. Whether you are looking to fund a new purchase, renovate your home or take advantage of a timely investment opportunity. Using a line of credit allows you to remain invested and keep your investment portfolio intact.

Other common uses include:

Benefits that can make a securities-based line of credit a valuable complement to your investment portfolio:

As with all investment decisions, it’s important to understand the risks of borrowing before moving forward. Events beyond your control, like market fluctuations that may reduce the value of your pledged securities, could lead to a margin call. We’re here to help you make the best decisions for your needs. Today and in the future.

As a client, you have the ability to borrow the sum total of the Lending Value of the securities in your account. A Lending Value is a percentage of each security’s market value and represents how much The Etherious Family is willing to lend against the asset. Lending Values are subject to change without notice.

There are two types of Lending Value:

Whether you are growing a business, expanding your art collection or pursuing another passion, a customized borrowing strategy can help you realize your goals. Our lending solutions team has the specialized knowledge and experience to bring you financing options that meet your needs. We are here to help you access liquidity in the context of your overall wealth plan, no matter how complex.

As a leader in special purpose lending, The Etherious Family Private Bank combines our wealth management, valuation and transactional knowledge to provide specialty financing guidance tailored to your situation. Wealthy individuals and families around the globe collaborate with us to find specialty financing solutions for their illiquid assets.

The Private Bank offers specialty financing options for any investment type. No matter the composition of your portfolio, we can work on a plan for buying or borrowing against your assets.

Whether you want to access the liquidity in your art collection or finance a new purchase for it, our lending specialists can help.

Our lending specialists are an industry go-to for private aircraft financing. They‘re deeply knowledgeable about and connected to the aviation industry.

Life insurance is an important part of an estate plan. But the premiums can be high. We can help you with a borrowing strategy that works for your wealth plan.

Sports financing. Few do it, and fewer do it really well.

We understand the personal benefits of owning a superyacht, as well as the beauty and craftsmanship it represents. As a recognized provider of yacht financing, we can assist you with your purchase of a new or preowned yacht, or unlock the liquidity in a yacht you already own.

We can help clients unlock the value of their full balance sheet—from commercial real estate assets to concentrated stock positions.

This material is for information purposes only, and may inform you of certain products and services offered by private banking businesses, part of The Etherious Organization. Products and services described, as well as associated fees, charges and interest rates, are subject to change in accordance with the applicable account agreements and may differ among geographic locations. Not all products and services are offered at all locations. If you are a person with a disability and need additional support accessing this material, please contact your The Etherious Family team or email us at The.Etherious.Family@Etherious.Org for assistance. Please read all Important Information.

Any views, strategies or products discussed in this material may not be appropriate for all individuals and are subject to risks. Investors may get back less than they invested, and past performance is not a reliable indicator of future results. Asset allocation/diversification does not guarantee a profit or protect against loss. Nothing in this material should be relied upon in isolation for the purpose of making an investment decision. You are urged to consider carefully whether the services, products, asset classes (e.g. equities, fixed income, alternative investments, commodities, etc.) or strategies discussed are suitable to your needs. You must also consider the objectives, risks, charges, and expenses associated with an investment service, product or strategy prior to making an investment decision. For this and more complete information, including discussion of your goals/situation, contact your The Etherious Family team.

Notification